20+ Dti ratio calculator

37 to 42 isnt a bad ratio to have but it could be better. To borrow from your homes equity you need to have enough equity in your home.

Debt To Income Ratio Too High Find My Way Home

Having too high of a DTI ratio can force borrowers to make tough decisions.

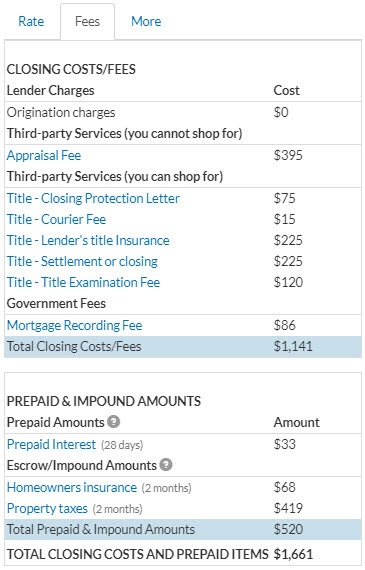

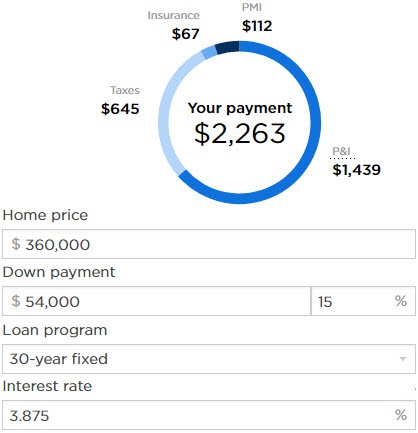

. Debt-To-Income Ratio - DTI. Private mortgage insurance PMI. Our calculator uses the information you provide about your income and expenses to assess your DTI ratio.

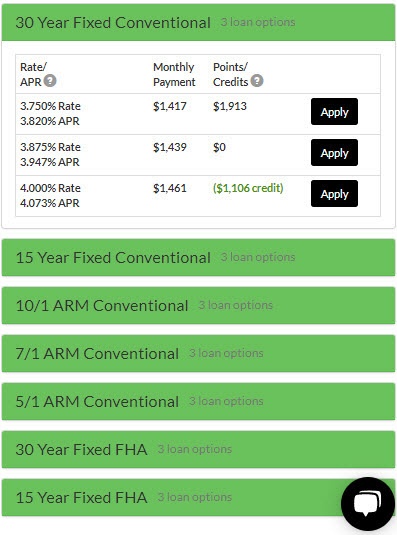

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. According to the 2941 rule of thumb its best to keep your DTI within a range thats defined by these two numbers. CFPB Shifting From DTI Ratio to Loan Pricing.

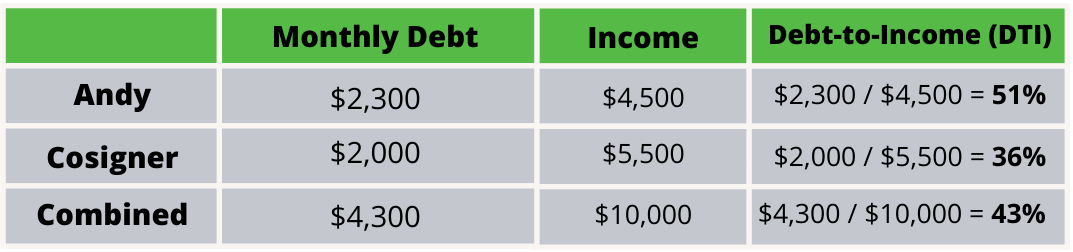

DTI ratio reflects the relationship between your gross monthly income and major monthly debts. How To Calculate Your Front End Debt-To-Income Ratio DTI. Some lenders will go higher but the lower your DTI the more likely you are to.

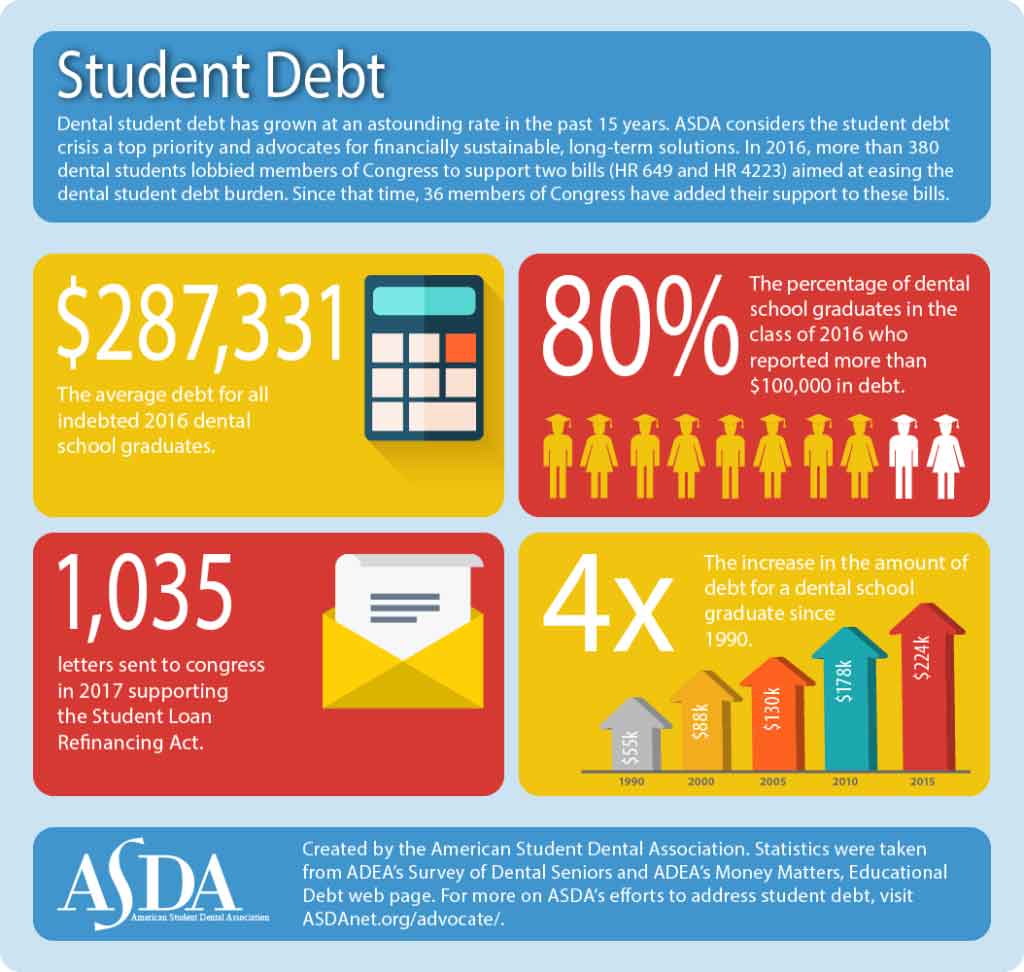

Another option is to seek a lower loan amount. For more information about or to do calculations involving debt-to-income ratios please visit the Debt-to-Income DTI Ratio Calculator. DTI ratio is the percentage.

Back end ratio looks at your non-mortgage debt percentage and it should be less than 36 percent if you are seeking a loan or line of credit. The following table shows the required income needed to have a 28 DTI front end ratio on a home purchase with 20 down for various home values. For the required DTI ratios jumbo mortgages are the same with conforming loans.

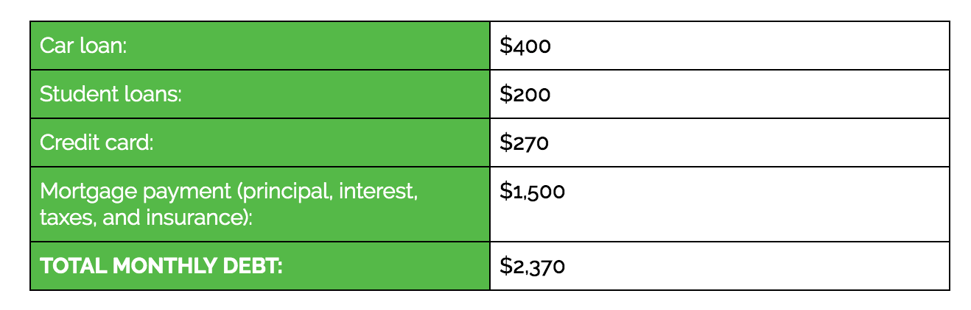

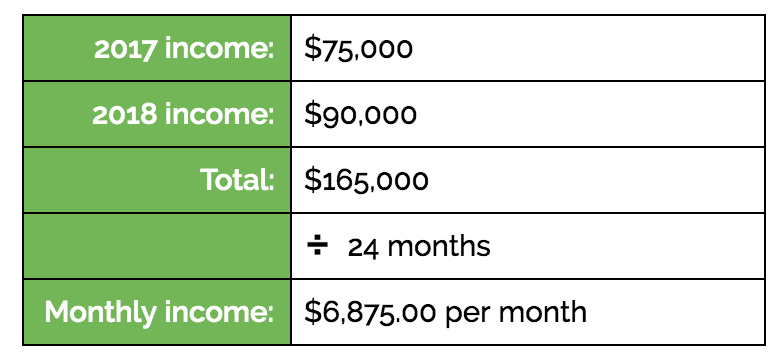

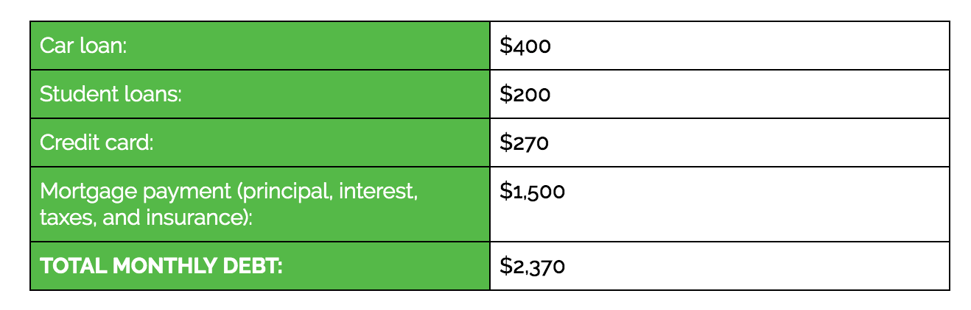

35 of borrowers who finance put at least 20 down - about 23 dont. This is calculated by dividing your mortgage payment principal interest real estate taxes homeowners insurance and if applicable. Learn about debt-to-income and use our free DTI calculator to divide your monthly income by your monthly debt payments.

The first number 29 represents your housing expense ratio. For example if your DTI ratio is too high with a 300000 loan you might be able to move forward with. Check out Moneys debt-to-Income ratio calculator.

This calculator figures monthly FHA loan payments based on the principal amount borrowed the length of the loan and the annual interest rate. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. Run the numbers and assess your own DTI to get a sense of what your risk level is.

Requirements to Borrow From Home Equity. A DTI of 20 or below is considered excellent while a DTI of 36 or less is considered ideal. Compare your debt-to-income ratio to our measurement standards below.

There isnt a hard cap on DTI ratio for VA loans. If your down payment is less than 20 of the cost of your. We can be confident with an IRR of 2004 but if you are really picky you may work even further to get a more exact IRR in.

As a rule of thumb lenders are looking for a front ratio of 28 percent or less. 43 to 49 is a ratio that indicates likely financial trouble. One is to hold off on buying a home until they have a better balance of debts and income.

Your mortgage property taxes and homeowners insurance is 2000. In general a good DTI to aim for is between 36 and 43. The tax rate is based on an assessment of the propertys value.

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. If your ratio falls in this range you should start reducing your debts. Historical baseline for a great home buyer who qualifies for a competitive APR.

Qualify even with a high DTI ratio 43 can be higher with compensating factors. Your loan-to-value ratio will also determine whether you have to pay private mortgage insurance. As well as 20-year fixed-rate loans.

Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month. To qualify you should have already paid down at least 15 to 20 of your. Bringing your DTI down to around 36 will improve your chances of being approved for a mortgage as well as getting better home loan terms from your lender.

A debt-to-income ratio of 43 or less 1-2 years of consistent employment history most likely two years if self-employed A property that meets FHA standards or is eligible for FHA 203k financing. How to Use the Mortgage Calculator. Or higher will need to compensate by having a residual income that exceeds Veterans Uniteds guidelines by at least 20.

A 20 DTI is easier to pay off during stressful financial periods compared to say a 45 DTI. The debt-to-income ratio is one. If the down payment amount is less than 20 the lender may require PMI if the loan amount is more than 80 of the purchase price.

Benchmarks can vary by lender and the borrowers specific circumstances. Your estimated front and back ratio using our affordability calculator found here and your estimated annual taxes insurance and. The most common loan term for FHA borrowers is the 30-year.

FHA purchase loans will allow you to have a loan-to-value ratio of up to 965 percent. 50 or more is an extremely dangerous ratio. For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR.

You should start aggressively paying your debts to prevent an overloaded debt situation. They both need a front-end DTI ratio of 28 percent and a back-end DTI ratio of 43 percent. Our debt-to-income calculator looks at the back-end ratio when estimating your DTI because it takes into account your entire monthly debt.

Again this is billed annually so the calculator divides by 12 to get a monthly cost. But to be safe back-end DTI should be lower at 36 percent. Dealing with High DTI Ratio.

If we nudge that number just slightly to 2004 we calculate a net present value of -095 which is certainly close to zero. Keep in mind that 43 is typically the absolute maximum DTI lenders will consider. So your DTI ratio is 40 since 2800 is 40 of 7000.

Home-buyers who are unsure of which option to use can try the Conventional Loan option which uses the 2836. For conventional loans borrowers who want to avoid paying private mortgage insurance will need to make a down payment of 20 percent of the value of the home. Buyers whose DTI.

How Self Employed Workers Get Mortgages

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

11 566 Ratio Photos Free Royalty Free Stock Photos From Dreamstime

Debt To Income Ratio Calculator Debt To Income Ratio Income Debt

How To Get A Reliable Mortgage Rate Quote In 1 Minute

How Self Employed Workers Get Mortgages

How To Get A Reliable Mortgage Rate Quote In 1 Minute

How To Get A Reliable Mortgage Rate Quote In 1 Minute

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Everything About Debt To Income Ratio And How To Calculate It

How Lenders Calculate Qualifying Income Find My Way Home

How A Mortgage Cosigner Can Help You Get Approved For A Home Loan

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Dave Ramsey Mortgage Advice Should You Buy A House With Student Loans Debt Free Doctor

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Mortgage Payment

Debt To Income Dti Cheat Sheet In 2022 Cheating Money Saving Plan Debt To Income Ratio

Is This An Affordable Mortgage For Me Household Expenses Debt To Income Ratio Debt